|

|

Support and resistance is one of the most widely used concepts in trading. Strangely enough, everyone

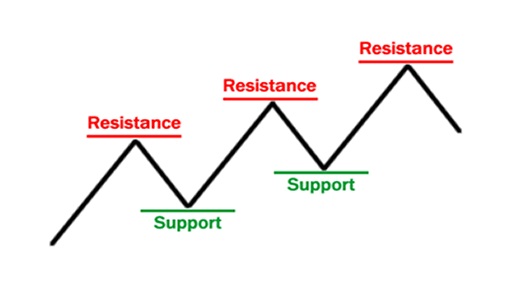

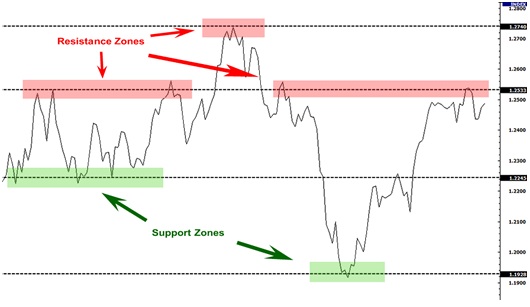

seems to have their own idea on how you should measure support and resistance.  Look at the diagram above. As you can see, this zigzag pattern is making its way up (bull market). When the TRADE market moves up and then pulls back, the highest point reached before it pulled back is now resistance. As the market continues up again, the lowest point reached before it started back is now support. In this way, resistance and support are continually formed as the market oscillates over time. The reverse is true for the downtrend. Plotting Support and Resistance One thing to remember is that support and resistance levels are not exact numbers. Often times you will see a support or resistance level that appears broken, but soon after find out that the market was just testing it. With candlestick charts, these “tests” of support and resistance are usually represented by the candlestick shadows.  Notice how the shadows of the candles tested the 1.4700 support level. At those times it seemed like the market was “breaking” support. In hindsight we can see that the market was merely testing that level. When plotting support and resistance, you don’t want the reflexes of the market. You only want to plot its intentional movements. Looking at the line chart, you want to plot your support and resistance lines around areas where you can see the price forming several peaks or valleys.  Other interesting tidbits about support and resistance:

Now that you know the basics, it’s time to apply these basic but extremely useful technical tools in your trading. we want to make things easy to understand, we have divided how to trade support and resistance levels into two simple ideas: the Bounce and the Break. Bounce As the name suggests, one method of trading support and resistance levels is right after the bounce. Many retail TRADE traders make the error of setting their orders directly on support and resistance levels and then just waiting to for their trade to materialize. Sure, this may work at times but this kind of trading method assumes that a support or resistance level will hold without price actually getting there yet. You might be thinking, “Why don’t I just set an entry order right on the line? That way, I am assured the best possible price.” When playing the bounce, we want to tilt the odds in our favor and find some sort of confirmation that the support or resistance will hold. Instead of simply buying or selling right off the bat, wait for it to bounce first before entering. By doing this, you avoid those moments where price moves fast and break through support and resistance levels. From experience, catching a falling knife when trading can get really bloody… Break In a perfect world, support and resistance levels would hold forever, McDonald’s would be healthy, and we’d all have jetpacks. In a perfect trading world, we could just jump in and out whenever price hits those major support and resistance levels and earn loads of money. The fact of the matter is that these levels break… often. |